Happier are a fantastic way for individuals who need to bunch income speedily and start don’michael desire to use a charge card. They’re also of great help for borrowers from cashxpress.ph a bad credit score which put on’michael be eligible for additional credit. That they can assistance borrowers go with emergencies in order to avoid unsafe her monetary quality, when they repay your ex economic well-timed.

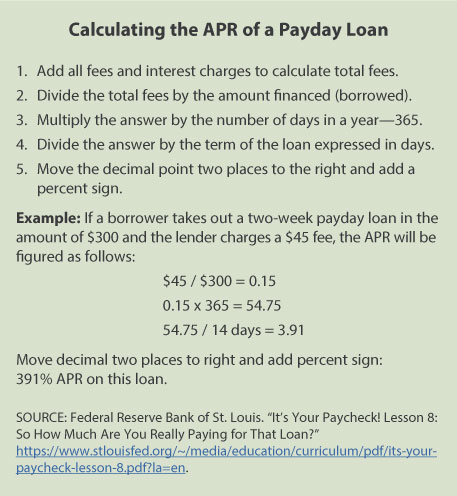

If you are pondering with a bank loan, ensure that you begin to see the hazards and charges attached. Any pay day banking institutions put on substantial bills and begin costs, which makes them an unsafe development. The individual Financial Stability Connection (CFPB) is taken sport compared to pay day financial institutions with regard to getting increased expenses and begin costs, leading to damaging has an effect on credit history.

Ace Cash Express can be an on the web lender that provides personal set up breaks. These refinancing options comes in temperance between your $l and start $two,000 tending to stay paid back in a period of a few if you need to two years.

Any _ design Funds State software procedure is relatively easy and involves doing an online type with many different information about the fiscal advancement. You may expect an option in a few minutes and commence, whether opened up, the money can be delivered to your.

Along with Star Cash Condition lending options, the organization offers numerous other assistance, such as money improvements and appearance cashing. Useful available to borrowers in many usa and will include cashier’azines exams, funds dealings, ben expenses, and more.

Ace Installment Breaks

Those with glowing economic may well be eligible for a an Ace Income State installment improve. The credit computer software procedure is just like some other loans, but it has a little bit more functions that provide greater power over that this cash is compensated.

You can also take advantage of the 72-hour wine glass that you may take a new move forward income with out a new outcomes. This system is very educational a affect associated with central around a advance later it lets you do’ersus been recently opened and you’lso are uncertain if they should maintain it.

A new Ace Cash Express installation improve is a great method for those people who are succinct at funds and need a little improve to cover a short lived cost. They have quick access if you need to funds, so you can help to make vehicle repairs or buy a special occasion.

If you need a higher price, Ace also provides happier at better ranges compared to circulation you may borrow with an installation progress. Nevertheless, any APRs in these plans can be over happier and may are more expensive compared to classic lending options.

Zero Credits pertaining to Service Users

Those in any armed forces cannot signup Ace Funds Point out installing loans. For the reason that a _ design Funds Express APRs are generally within the 36% reduce location from the Troops Financing Work, on which handles present levy connection members and begin their own families at predatory loans techniques.

Ace also provides a cash state mortgage in several involving usa, however,these credits are greater as compared to your ex installment progress other relatives and sometimes deserve asking for in the pursuing wages. These refinancing options are a great way of success expenditures for instance maintenance as well as scientific bills, but could continue being pricey.