Content

- Join over 140,000 fellow entrepreneurs who receive expert advice for their small business finances

- Doesn’t shift the payment risk.

- How Invoice Factoring Can Benefit Your Company

- How Do I Start Factoring? What Do I Need?

- Monthly and Termination Fees

- Factoring Period

- Services

- Disadvantages of factoring

In answer to your needs, we have built a data integration platform on which you could apply for funding easily. Any business owner can relate to the problem of having more month than money, but it doesn’t have to be that way for you. The company and the main owners must not have an active bankruptcy. It won’t solve them entirely, but the damage to your business’s reputation will be far less severe. Check the financing limit available on your deal or go straight to Stenn’s easy online application form.

This feature makes invoice factoring an ideal solution for companies experiencing an aggressive growth stage and needing financing that can keep up with the level of growth. Most large commercial and government clients insist on paying invoices on 30-day to 60-day terms. If you cannot offer payment terms, your chances of landing these companies as clients are minimal. Factoring enables you to offer payment terms to your clients because you can finance your invoices shortly after creating them (as long as the goods/work has been delivered). Therefore, you can offer terms without the negative financial consequences.

Join over 140,000 fellow entrepreneurs who receive expert advice for their small business finances

If you happen to be a founder, your company’s equity is something you would want to protect. As a founder-friendly growth partner, Choco Up does not take any equity, options or warrants from your company. As Choco Up only shares a small portion of your monthly revenue as repayment, you will pay back more when you earn more, pay back less when you earn less in a particular month. Without complex application or vetting procedures, Choco Up could give you access to funding in as little as 48 hours.

What is another name for invoice factoring?

Invoice Factoring (also know as debt factoring) is a type of invoice financing that allows you to release cash quickly from your sales ledger on an ongoing basis, to improve your cashflow.

Depending on the factor and the factoring period, it could range from two to 10 percent of the invoice. If you’re also dealing with a large amount of invoices within https://www.bookstime.com/ a given time frame, this rate could be lower. Always ask your factoring company about how their discount rate is determined, and what you can do to get the best rate.

Doesn’t shift the payment risk.

To begin, you simply have to fill out an online application form and connect your sales accounts (e.g. Google Analytics, PayPal, etc.) on our platform. Even though each of these fees may not sound like much, they could add up to a very high cost, increasing the cost of capital and undermining your profits from sales. Invoice Factoring allows you to get the capital you need when you need it and without taking on a loan. Invoice factoring gives your business the cash you need quickly and easily. Aside from the cost differential between the two, there are times when the cost differential is not justified by the credit risk being taken. A traditional, high-interest bank loan can be very expensive, not to mention the immediate debt incurred with obtaining one.

What is an example of invoice factoring?

Invoice factoring costs are typically charged as a percentage of the invoice amount. For example, if a factoring company charged a 1% fee for an invoice sum of $100 000 (USD), it would take $1 000 (USD) from the final invoice amount. Other factors can influence the cost of invoice financing services.

Below is how we achieve these goals with revenue-based financing. However, invoice factoring comes with various drawbacks — high costs, minimum volume commitment, as well as potentially negative customer perception. Factoring companies would look at your customers’ creditworthiness as one of the considerations to determine whether your factoring application should be approved. To prevent creating a negative impression on customers, some businesses avoid factoring their invoices unless it is really necessary. Non-recourse factoring may also be limited to customers with good credit histories, so that a non-recourse arrangement is not always available to you. If your business is structured with a long delay between sales and payment, factoring your invoices is one way to get your hands on cash quickly.

How Invoice Factoring Can Benefit Your Company

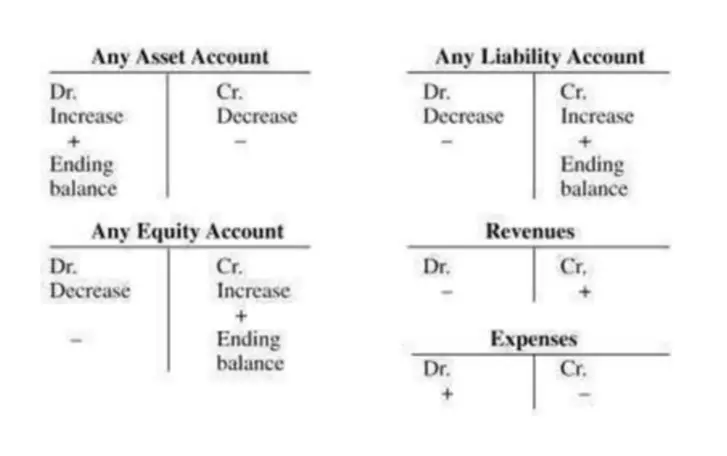

Other than the collection process (i.e. assignment), both forms of financing are nearly identical. Because it’s a sale, not a loan, it doesn’t impact your credit like traditional bank financing. To prevent any confusion, the term “factoring” is often used interchangeably with “accounts receivable financing”. It allows small businesses to unlock the cash value of their invoices long before their customers pay their bills.

Unlike loans, there is no obligation to make a certain amount of repayment by a certain date. With revenue-based financing, you never have to worry about the situation where debt commitments drag your company down and hinder growth. In revenue-based financing, RBF funding is advanced in a lump sum. Upon providing growth capital to you, Chooc Up would share a small percentage of your monthly revenue until the principal plus a flat fee is repaid.

How Do I Start Factoring? What Do I Need?

To this end, you may need to provide personal guarantee to repay the amount of invoice in the event of customer non-payment. We forward your invoices to your customers and they pay us directly. If you would like to learn more about what invoice factoring is, watch the videos below.

The first part is the « advance » and covers 80% to 85% of the invoice value. The remaining 15% to 20% is rebated, less the factoring fees, as soon as the invoice is paid in full to the factoring company. A business provides work, services, or products to their customers. When the customer is billed, the unpaid invoice is sent to the factoring company first. The factoring company advances the business, a percentage of the value of the invoice, generally 90%, that same day.

Monthly and Termination Fees

Our editorial team does not receive direct compensation from our advertisers. If you meet any or all of the characteristics below, it may be the right solution for your business. While the overall https://www.bookstime.com/articles/what-is-invoice-factoring goal of invoice factoring is the same, choosing the right provider is critical. Read more about all of the advantages and disadvantages of factoring and the invoice factoring approval process.